Likewise, money spent by the company is recorded on the service date regardless of whether the purchase is made with cash or credit. Whether the customer pay immediately (Cash) or purchases on credit (Accounts Receivable), Income is recorded. A customer purchase is recorded as revenue on the date the service is performed or good is delivered. Cash accounting focuses primarily on how much cash the business has on hand at any given time.Īccrual accounting, on the other hand, takes into account the company’s future revenues and expenditures. Wages paid to an employee are only recorded as an expense when the check is issued. If the company buys office supplies on credit and pays for them later, the expense is recognized only when the bill is actually paid. For instance, if a customer is billed for a purchase in September and pays the bill a month later, the revenue is recorded when the payment is received in October.

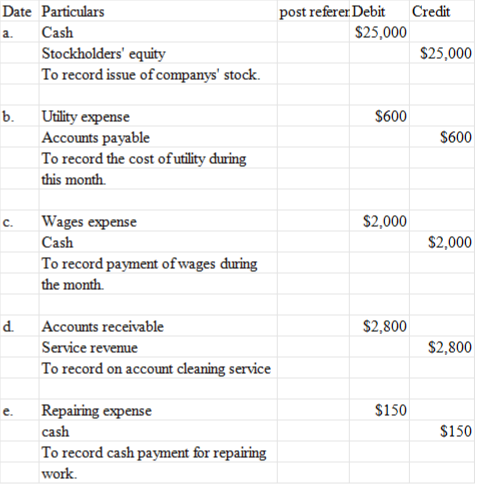

By recognizing revenue and expenses in the proper period and not when money actually changes hands, stakeholders receive an overall picture of financial health that allows business owners and investors to make good financial decisions. With accrual accounting, these future payments (made or received) are recorded when the service happens or the good is delivered. Many financial transactions are completed through credit or invoicing at a later date. Companies and businesses may be federally required to use accrual accounting based on their industry and/or based on their size as measured by revenue thresholds, and many others choose to use it because of the enhanced information it provides.Īccrual accounting gives a more accurate, real-time view of a company’s finances. Although cash accounting may be easier to do, accrual accounting gives a much more accurate view of a company’s financial position at a given time and its future prospects. In the accrual method, revenues and expenses are matched and recorded at the time the good is delivered or the service is performed, regardless of when cash actually changes hands.

:max_bytes(150000):strip_icc()/final5468-d59a89b4ff49437d99fe74b841514308.jpg)

In cash accounting, transactions are recorded when payment occurs. This means that revenue is recorded when the goods or services are delivered, not when the payment is received.There are two methods of accounting: cash and accrual.

The accrual basis of accounting recognizes revenues when they are earned, regardless of when the cash is received from the customer. Closing entries are necessary to transfer the balances of temporary accounts (revenues, expenses, and dividends) to the retained earnings account.ĥ. The accrual basis of accounting requires that closing entries be recorded before preparing financial statements. It is different from the cash basis of accounting, which recognizes revenues and expenses when cash is received or paid.Ĥ. The accrual basis of accounting is also called the accrual method or the accrual accounting method. Adjusting entries are necessary to ensure that revenues and expenses are properly matched and recorded in the correct period.ģ. The accrual basis of accounting does not eliminate the need for adjusting entries at the end of each period. This means that expenses are recorded when they are incurred, regardless of when the cash is paid or received.Ģ. The accrual basis of accounting recognizes expenses when they are incurred to generate revenue.

0 kommentar(er)

0 kommentar(er)